Ever wondered how a loan app verifies your identity and bank details in the time it takes to order a coffee? India processed more than 8.8 billion eKYC transactions in 2023, and that scale has completely transformed how digital lenders onboard customers.

For users, the process looks almost effortless. You upload a few details, take a quick selfie and sign digitally, and the app tells you whether you’re approved. Behind the scenes, a tightly connected workflow runs identity checks, validates documents, matches your face, confirms your bank account and seals the loan agreement in a legally compliant way.

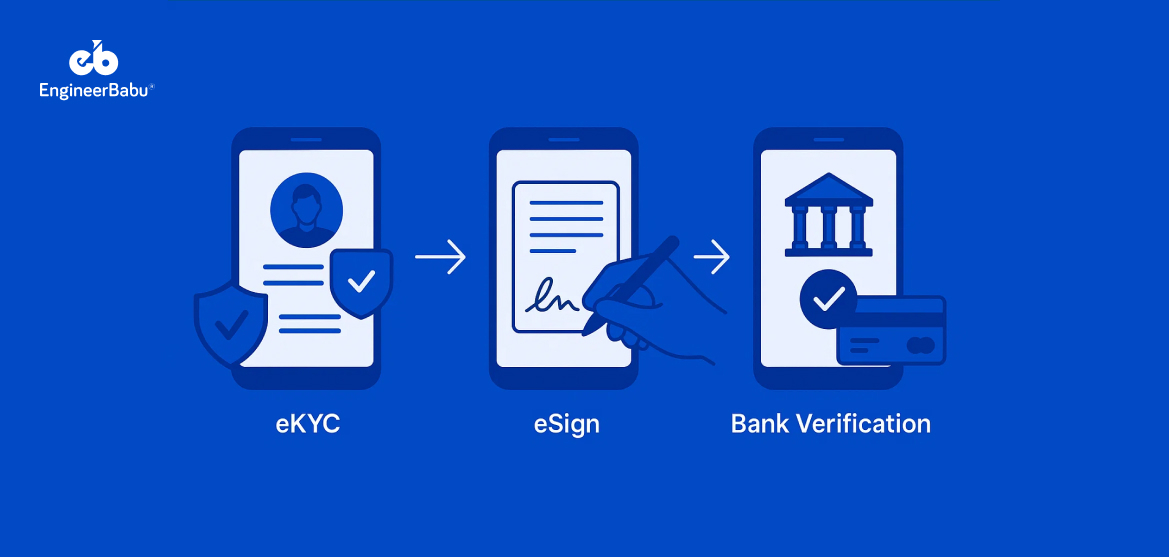

In this guide, we’ll break down how eKYC, eSign and bank verification actually work inside a loan app, why these steps are essential for fraud prevention, and how lenders automate the entire journey without compromising on security or user experience.

What is eKYC in Loan Apps?

eKYC is the digital method lenders use to verify a borrower’s identity with accuracy and speed. Instead of collecting photocopies of documents or doing in-person checks, loan apps use automated tools to confirm who the user is and whether the information they provide is legitimate.

In India, eKYC sits at the core of every digital lending journey. Lenders rely on multiple verification routes depending on the user’s profile and regulatory requirements. Aadhaar-based eKYC allows the app to retrieve verified identity data after the user authenticates through OTP. Offline Aadhaar XML gives users more control by letting them download and share an encrypted XML file that proves their identity without exposing their Aadhaar number.

Many lenders also plug into CKYC to fetch KYC records already verified by regulated entities. For higher-risk cases, video KYC adds a human-in-the-loop review where an authorised officer completes a live identity check.

How eKYC Works in a Loan App

User enters basic details

The journey starts with simple information like name, date of birth and address. These details help the system map the user to the right verification path and prepare the data for matching.

ID verification begins

The user either uploads an ID document or authenticates through Aadhaar.

- If a document is uploaded, OCR extracts the text and checks for signs of tampering.

- If the user chooses Aadhaar, verified demographic data is retrieved after OTP authentication.

Selfie or video capture

The app asks for a selfie to confirm that the person using the device is the same person on the ID. Face match compares the two images, while liveness detection looks for natural movements to prevent spoofing attempts.

Cross checks against databases

The extracted details are validated across trusted sources. PAN is checked for accuracy, Aadhaar information is matched with the shared data and any inconsistencies are flagged for review.

Risk assessment and decision

All verification signals are combined to generate a risk score. If the checks pass, the user can continue with the loan journey. If the system detects mismatches, the case may be routed for manual review or declined.

What Is eSign in Digital Lending

eSign allows borrowers to sign their loan agreement digitally without printing or uploading anything. It gives lenders a legally valid signature that proves the user reviewed and accepted the terms.

Most loan apps rely on Aadhaar eSign because it links the signature to a verified identity. The user enters their Aadhaar number, receives an OTP and confirms the request. Once authenticated, a digital certificate is issued and attached to the loan agreement. The document is then sealed with a timestamp and an audit trail so lenders can prove the signature was genuine and approved by the borrower.

This simple flow removes paperwork, speeds up disbursement and keeps the entire lending process fully digital.

How eSign Works in a Loan App

The user reviews the loan agreement

The app shows the final loan document with all terms, charges and repayment details. The user reads and confirms that they are ready to sign.

The app asks for consent to eSign

Before initiating the process, the user gives explicit consent to sign digitally. This confirmation is recorded for compliance.

The user completes Aadhaar or OTP verification

Depending on the method the lender supports, the user verifies identity through Aadhaar-based authentication or a mobile OTP. This step links the signature to a verified identity.

A digital signature certificate is generated

Once authentication succeeds, a certifying authority issues a digital signature certificate tied to the user. This certificate proves who signed the document and when.

The loan agreement is sealed and timestamped

The eSigned document is locked, encrypted and stamped with an audit trail. The file now becomes legally valid and tamper evident.

The user receives a signed copy instantly

The app shares the completed agreement with the borrower and stores a secure copy for future reference.

How Bank Verification Works in a Loan App

The user enters their bank account details

The flow begins when the user provides their account number and IFSC. This helps the system identify the bank, branch and the verification method that will be used.

The app initiates an ownership check

Most lenders start with a penny drop or API-based lookup. A small test amount is sent or an instant API call is triggered to confirm that the account belongs to the user and is currently active.

The system matches the account holder’s name

The returned bank data is compared with the user’s KYC information. The system checks for spelling variations, formatting differences and initials to ensure the name belongs to the same individual.

The app verifies account status and validity

The system checks whether the account is open, operational and eligible for receiving disbursements. Dormant, frozen or flagged accounts are immediately highlighted.

The user provides bank statements for deeper checks

Depending on the loan type, the app may request statements through netbanking login, PDF upload or API aggregators. If PDFs are uploaded, OCR reads transactions and detects inconsistencies.

The system analyses income patterns and stability

The extracted statement data is used to evaluate salary credits, cash flow patterns, EMI history and suspicious transactions. These insights help refine the borrower’s risk profile.

The verification result is sent to underwriting

Once all checks align, the verified bank details are passed to the underwriting engine. If everything looks consistent and stable, the user moves to the next step in the loan process.

Conclusion

eKYC, eSign and bank verification form the backbone of every smooth and secure digital lending journey. They allow loan apps to onboard users quickly while still meeting strict compliance and fraud-prevention standards. Each layer plays a specific role. eKYC confirms identity, eSign seals the agreement in a legally valid way and bank verification ensures that funds move to the correct and verified account.

Together, they create a fast, reliable and safe borrowing experience that works at scale. As digital lending continues to grow, these verification systems will only become more advanced, more automated and more user friendly.

FAQs

1. Is eKYC mandatory for taking a loan from a digital lending app?

Yes, lenders must complete KYC as required by RBI before approving a loan. Most apps use eKYC because it is faster and more secure than physical verification.

2. What makes eSign legally valid in India?

eSign is backed by the Information Technology Act. Aadhaar-based eSign includes certificate issuance, timestamping and an audit trail, which makes the signed document legally enforceable.

3. How long does bank verification take in a loan app?

It usually takes a few seconds. Methods like penny drop or API-based verification confirm account ownership almost instantly.

4. Can bank verification fail if the name on the account is slightly different?

Yes, mismatched spellings or name formats can trigger a failure. Many lenders use fuzzy-match logic to handle minor differences, but major mismatches may require manual review.

5. What happens if my loan is approved but eSign does not go through?

The loan cannot be disbursed until the agreement is successfully signed. The app usually prompts the user to retry the eSign process or switch to an alternative signing method.